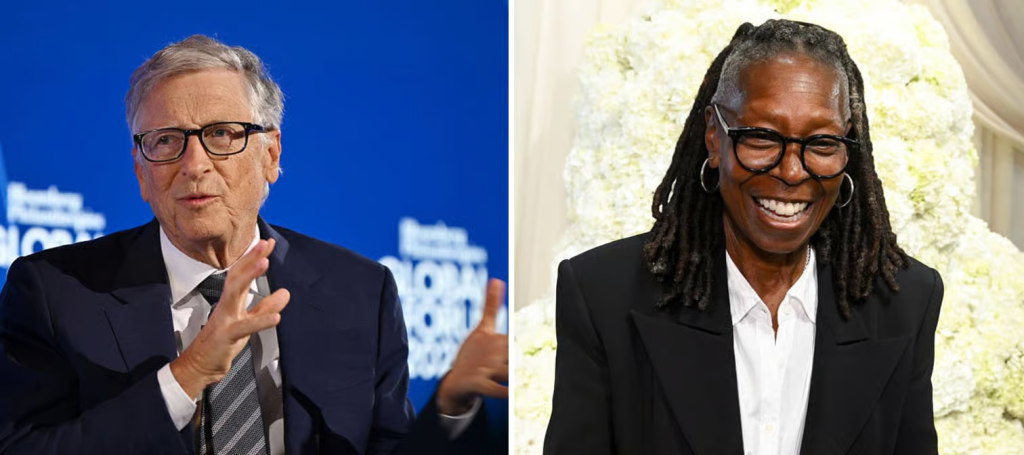

If you were born in 1955, congratulations! You are the same age as Kris Jenner, Bill Gates and Whoopi Goldberg! You are also eligible to collect the maximum Social Security benefit, if you waited this long to claim it.

If your taxable wages in your last year of work were above the social security wage cap of $176,100, you’ll probably be happy to know that you, Kris, Bill and Whoopi are all eligible for the same benefit amount of $5,108 per month. The good news is that no matter how wealthy your celebrity friends are, you all get the same maximum amount. The bad news is, you have to have paid into Social Security for most of your working life, which extends to your 70th birthday, to get anywhere near that much (1).

How is your Social Security benefit calculated?

The Social Security benefit calculation starts with your highest 35 years of earnings, adjusts those years for wage growth, and averages them to get your average indexed monthly earnings (AIME). Your AIME feeds into a three-tier “bend point” formula to produce your primary insurance amount (PIA) which is the base of your monthly benefit. The bend points are inflection points that change how much of your income is replaced by Social Security.

In 2025, the bend points are $1,226 and $7,391. The formula replaces 90% of the first slice of your AIME, 32% of the next slice, and 15% above the second bend point. Cost-of-living adjustments and how old you are when you file moves your payment up or down. The method is similar to how progressive income taxes are calculated. The first $1,226 of your monthly income is replaced by your benefit. The next $6,165 of your monthly income is replaced up to 32%, and so on up to the income cutoff, which is $4,018 for those at full retirement at (66 years and two months) in 2025 (2).

Your filing age also matters. For folks born in 1955 the full retirement age (FRA) is 66 and 1/6, as mentioned above. The FRA has been marching steadily upwards since the Social Security Act was amended in 1983 (3).

For those of us born after 1960, the full retirement age is 67 years. You can still claim benefits starting at age 62, but you may only get 70% of your full payment. On the other hand, if you delay claiming your benefits until 70, you get an extra 8% of your full benefit for every year you don’t file. That’s why the same maximum earner would see $2,831 at 62, $4,018 at full retirement age, or $5,108 at 70 (4).

Lifetime earnings set your ceiling. To hit the absolute maximum, you need very high pay in your top 35 years, typically at or above the taxable wage cap in each of those years. The cap is $176,100 in 2025, and earnings above that do not boost your benefit. Workers who meet that bar across their career and wait until 70 are the ones who reach the top figure (5).

Must Read

What to consider when claiming your Social Security benefit

It might seem like everyone should work until they’re 70 and retire with a nice, hefty Social Security benefit, but like most things in life, it’s not that simple. First of all, our hypothetical scenario assumes you have been a high earner your whole life. The majority of Social Security recipients simply aren’t eligible for the highest benefit amount. For the rest of us, the average benefit for 70-year-olds is $2,148 (7).

Secondly, some people may not be able to work until they’re 70. Several studies and data analyses in the last ten years indicate that once you reach 50, you are likelier to be laid off and suffer a reduction in earnings (8). Disruptions to your career may lead you to recalculate your retirement timeline.

Depending on your family situation, you or your spouse may want to claim your benefit early and let the other partner wait for full retirement age or later. Third, some people calculate their “break even point” when thinking about when to claim their benefit. For example, if your benefit at 65 is $1,611, you will collect $96,660 before you turn 70, when you could claim your maximum benefit. If your benefit at 70 is $2,148, it will take you 15 years to make up the difference in earnings (7). If you plan to live to 95, the extra money is useful, but given the average life expectancy in the U.S. is about 79 as of 2019 (later statistics are affected by pandemic conditions), you may not break even on that calculation (8).

To get the highest benefit your earnings allow, you will need to create a my Social Security account, review your statement, and use the SSA’s calculators to test filing ages and work scenarios. Think of your Social Security benefit as the lifetime, inflation-adjusted income that will cover your essentials, and plan to use other sources of income, like retirement savings and income from part-time work, to fill the gaps.

Leave a Reply