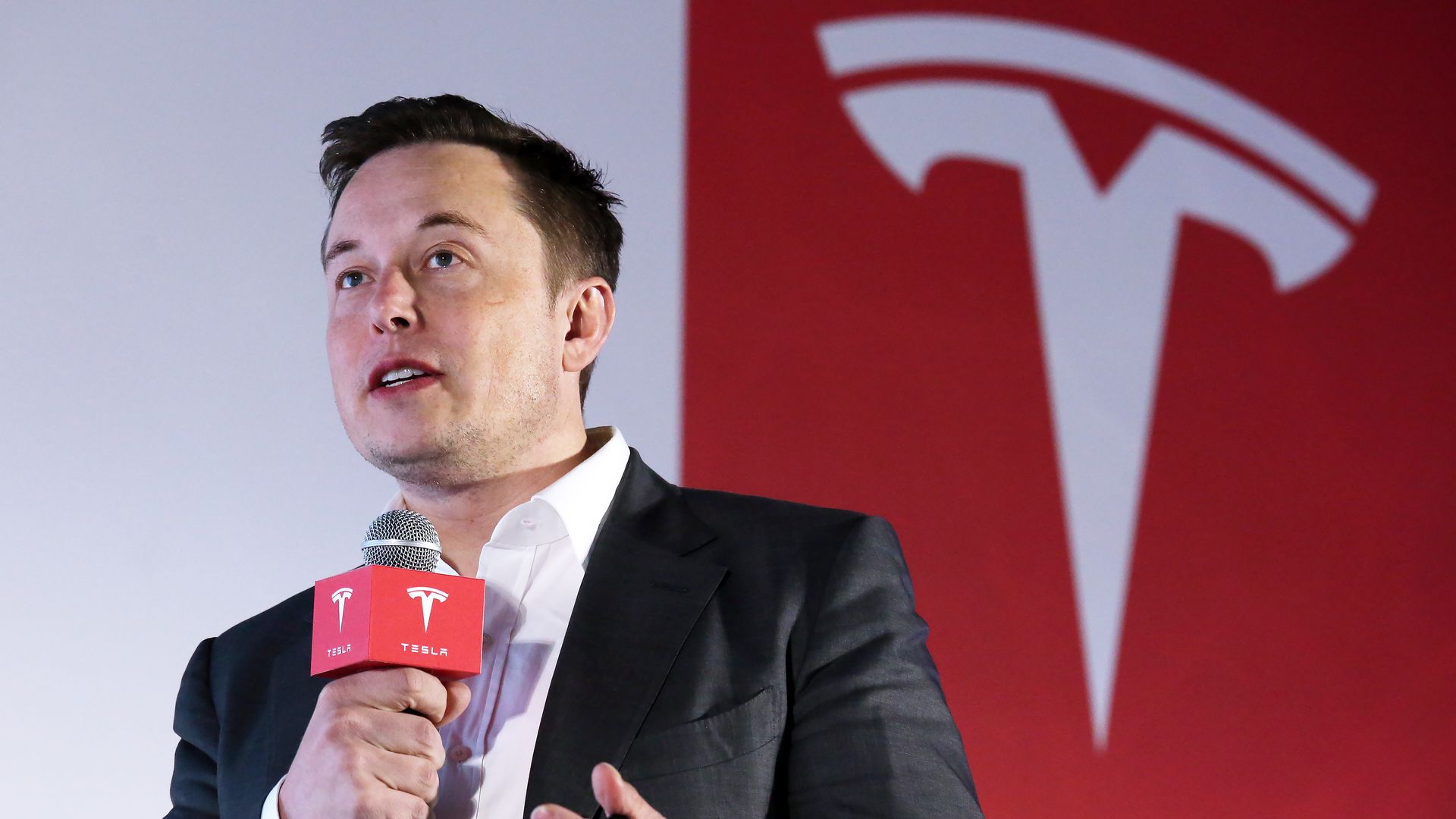

The Statement Heard Around the World

“I’m not doing it for the money.”

That one sentence from Elon Musk — the world’s most polarizing innovator — echoed across headlines, podcasts, and social feeds within hours. It came as Tesla’s board proposed what analysts are calling the most ambitious compensation package in corporate history: a performance-based deal that, if fully achieved, could make Musk the world’s first trillionaire.

Yet Musk insists this isn’t about wealth. It’s about protection. Protection of the company. Protection of Tesla’s mission. Protection of his right to steer humanity’s technological future without interference from corporate bureaucracy or short-term investors.

But is it truly selflessness — or simply the newest evolution of power in the modern age of capitalism?

The $1 Trillion Mirage

Tesla’s proposed package would reward Musk with massive tranches of stock options tied to extreme performance goals — milestones so high that even Wall Street analysts call them “mythic.”

If Tesla’s market valuation were to reach the targets laid out — hundreds of billions beyond even its current scale — the potential payout could approach $1 trillion in total value.

To Musk’s supporters, the numbers are symbolic, not greedy. They represent a man betting on his own vision — staking his fortune on success.

To his critics, they represent something else entirely: a concentration of wealth and control so vast it could redefine the limits of executive influence.

As Bloomberg put it, “It’s not just a pay package. It’s a power contract disguised as performance metrics.”

The Context: A Company at a Crossroads

Tesla today is more than a car manufacturer. It’s a global ecosystem of energy, robotics, and AI development. Its reach spans from solar roofs to humanoid robots to autonomous logistics.

But it’s also a company facing immense pressure. Competition from China is tightening. Electric-vehicle demand in some markets is plateauing. AI rivals are encroaching on Tesla’s once-untouchable software leadership.

In that environment, the board’s argument is clear: without Musk, Tesla might lose its magic.

They see him as irreplaceable — not just the CEO, but the beating heart of the brand.

So the proposal isn’t just a bonus. It’s a brace. It’s a way to lock Musk to Tesla for another decade, ensuring that his focus — and his power — remain where investors believe they belong.

The Myth of “I’m Not Doing It for the Money”

When Musk declared that his motivation wasn’t financial, it wasn’t the first time. Over the years, he has repeated versions of that line:

“I don’t care about the money. My money is just a way to make things happen.”

“I’m accumulating resources to help humanity become multi-planetary.”

“If I wanted money, I would’ve sold everything years ago.”

In Musk’s worldview, wealth is a tool — not a goal. But tools can still be weapons.

Because in modern corporate governance, money and control are indistinguishable. Every share, every stock option, every vote represents leverage over the future of a company, a market, and sometimes an entire industry.

By structuring his pay through Tesla equity, Musk positions himself not merely as a well-paid CEO, but as a permanent power center.

He doesn’t need a salary. He already has something more valuable — a gravitational field of influence.

The Shareholder Dilemma

The proposal has divided Tesla’s shareholders like few issues before.

Some see the package as a necessary investment in genius — a reward for the man who turned a niche electric-car company into one of the world’s most valuable corporations.

Others see it as an abuse of loyalty — a way for Musk to cement near-monarchical control over a company that should belong to its investors, not its founder’s ambition.

Proxy advisory firms such as ISS and Glass Lewis have urged shareholders to reject similar proposals in the past, warning of “outsized rewards” and “poor governance optics.”

But here’s the paradox: the stock market often rewards charisma as much as competence.

When Elon Musk wins, Tesla’s valuation rises on belief — not just on profit margins.

And that belief, that cult of confidence, is exactly what this pay package monetizes.

Musk’s Counterargument: Control Is Stability

Musk’s defense of the package is simple and direct:

“It’s not about the cash. It’s about ensuring that I can protect Tesla from forces that would derail its mission.”

He frames the issue not as greed, but as governance — a struggle between visionary leadership and bureaucratic dilution.

In his mind, without his controlling stake, Tesla risks becoming “just another corporate automaker,” bogged down by committees and short-term quarterly thinking.

His reasoning resonates with his base. Musk has long portrayed himself as the guardian of innovation — a man whose unconventional methods (and frequent controversies) are the price of progress.

To them, “protecting Tesla” means ensuring that bold decisions — from building gigafactories to developing AI-powered robots — don’t get vetoed by timid executives or activist shareholders.

But to skeptics, the same argument sounds dangerously close to autocracy dressed as altruism.

The Psychology of Power and Genius

Elon Musk’s relationship with power has always fascinated psychologists and business scholars.

He thrives on risk, thrives on control, thrives on defying convention. His companies — SpaceX, Neuralink, X (formerly Twitter), and Tesla — are built around his singular vision.

Dr. Ayesha Patel, a behavioral economist at Oxford, explains it this way:

“Musk equates control with responsibility. To him, losing control means betraying the mission. But that mindset also leads to a paradox — the more power he gains to protect his mission, the less accountability he faces.”

This paradox sits at the core of Musk’s persona. The same confidence that enables him to land rockets or build trillion-dollar companies can also justify decisions that concentrate authority in his own hands.

It’s the psychological price of being both visionary and indispensable.

The Courtroom Shadow

This isn’t the first time Musk’s pay has sparked controversy.

In early 2024, a Delaware judge struck down his previous $55 billion pay package, calling it “an unfathomable sum” and criticizing Tesla’s board for failing to exercise proper oversight.

The ruling cited a “deeply flawed process” and “a board that lacked independence from its CEO.”

That judgment forced Tesla to craft a new proposal — one that Musk insists will withstand scrutiny because it ties his compensation strictly to company success.

But critics argue that even performance-based incentives can mask excessive control if the CEO sets the very goals that trigger them.

“When the same person writes the rules, plays the game, and owns the scoreboard,” one governance expert quipped, “you don’t have a contest. You have coronation.”

The Vision Beyond Earth

To Musk, wealth has always been a means to an end — the interplanetary end.

He’s said repeatedly that he intends to use his fortune to fund humanity’s expansion beyond Earth.

“The reason I accumulate assets,” he told Time, “is to ensure we become a multi-planet species. That’s the real legacy.”

In that light, the trillion-dollar figure becomes symbolic — not of greed, but of scale.

Because for Musk, everything he touches operates on cosmic scale:

- Colonizing Mars.

- Building fully autonomous transportation.

- Creating artificial intelligence aligned with human values.

- Restructuring the global energy grid.

Each of those ambitions requires resources — and, in his view, uncompromised control.

The Cult of Musk

No discussion of Musk’s influence is complete without acknowledging his followers.

Tesla investors don’t just hold stock; they hold faith. Online communities treat his words like scripture.

When Musk tweets, markets move. When he speaks, entire industries adjust their course.

That’s not traditional corporate power — that’s cultural gravity.

It’s why this pay debate feels less like a financial negotiation and more like a referendum on belief.

To many of his fans, the $1 trillion package isn’t outrageous; it’s destiny.

To his critics, it’s delusion — proof that capitalism has blurred into hero worship.

Either way, it’s a phenomenon unique to Musk: a man who can merge engineering, economics, and emotion into a single brand of influence.

The Public Response: Admiration Meets Anxiety

Public opinion is as split as ever.

Supporters call the package a well-deserved vote of confidence. They argue that Musk has delivered results no other CEO in history could replicate: a company that reshaped global transportation and forced entire industries to electrify.

Opponents call it tone-deaf — a grotesque symbol of wealth inequality in a world where millions still can’t afford the very electric cars Musk built.

Editorials across the spectrum are divided:

- The Wall Street Journal: “You pay greatness what greatness demands.”

- The Guardian: “Trillion-dollar paydays don’t build cars — they build cults.”

- Financial Times: “Musk’s genius is unquestionable. His governance is not.”

Meanwhile, online memes show Musk holding a “Mission > Money” sign — half mockery, half admiration.

The Question of Legacy

Every titan faces the same eventual question: what will outlast them?

For Elon Musk, the answer might not be Tesla cars or SpaceX rockets, but the model of leadership he’s creating — one where personality and profit merge completely.

He is, in effect, the prototype for a 21st-century autocrat of innovation: a figure who wields influence not through state power, but through capital, charisma, and code.

Historians may one day call it “Muskism” — a blend of visionary zeal and centralized authority.

The Economic Ripple

The implications of this pay package extend far beyond Tesla.

If it’s approved, it will set a new precedent for executive compensation. CEOs across industries could point to it as justification for “performance-linked megadeals,” arguing that genius deserves exponential reward.

That could reshape the balance of corporate governance worldwide — shifting power further from boards to superstar executives.

Already, tech companies are watching closely. Venture capitalists whisper that the “Musk Model” — massive risk, massive reward, zero humility — could become the new Silicon Valley standard.

In that sense, this isn’t just a Tesla story. It’s a test of how far capitalism is willing to go to reward its icons.

The Human Side of the Machine

Lost in the headlines is the question of what all this means for Musk himself.

He’s 54 years old. He runs multiple companies across multiple time zones. He sleeps in factories. He eats at his desk. He seems perpetually on the edge — brilliant and burned out in equal measure.

Is this pay package truly about motivation — or validation?

Psychologists who study high achievers describe a pattern: the more success they accumulate, the more they need new goals to justify their intensity.

Dr. Marcus Feldman, an organizational behavior expert, explains:

“For Musk, control isn’t about greed. It’s existential. Without it, the narrative of his life — the savior of humanity — collapses.”

“Protecting Tesla” — or Protecting Himself?

Musk says the package ensures he can “protect Tesla.” But protect it from what?

Insiders suggest the answer isn’t competition — it’s constraints.

He fears being sidelined by regulators, institutional investors, or cautious board members who might resist his more radical ideas.

The pay package is, therefore, not a reward but a shield — legal and financial armor against interference.

It ensures that as long as Tesla thrives, so does his autonomy.

In essence, it’s a contract that ties the company’s destiny to his own.

The Trillion-Dollar Question

So what if he succeeds? What happens if Tesla hits every target and Elon Musk becomes the world’s first trillionaire?

Would he still say it’s “not about the money”?

Maybe he would — and maybe he’d mean it.

But in a world where financial power translates directly into political, technological, and cultural power, the distinction may no longer matter.

Because at that level, money is power — and power is the story.

The Final Analysis

Let’s strip the myth from the man for a moment.

- Fact: Musk’s leadership transformed industries.

- Fact: His work ethic and ambition are unmatched.

- Fact: He has earned enormous wealth through results, not inheritance.

- Fact: His control of Tesla raises legitimate governance concerns.

All can be true at once.

The $1 trillion debate isn’t about greed vs. genius. It’s about the evolving relationship between vision and accountability.

It’s about whether society still believes in the idea that a single person — however brilliant — should hold such concentrated power in the name of progress.

The Verdict of History

One day, this moment will appear in business textbooks, right alongside Rockefeller, Ford, Jobs, and Gates.

But how it’s remembered will depend on what comes next.

If Musk’s leadership drives Tesla to even greater heights — if his vision truly pushes humanity forward — the trillion-dollar deal will be seen as a masterstroke.

If it backfires, it will be remembered as the moment ambition tipped into empire.

Either way, the phrase “I’m not doing it for the money” will live on — as either proof of integrity or irony.

Closing Thoughts

Elon Musk stands at the intersection of idealism and empire.

His fans hear a promise: a leader who dreams beyond profit.

His critics hear a warning: a man who hides power behind purpose.

Both may be right.

Because in the end, Musk’s real currency isn’t money — it’s belief.

And belief, once monetized at this scale, is the rarest and most dangerous form of wealth there is.

Leave a Reply