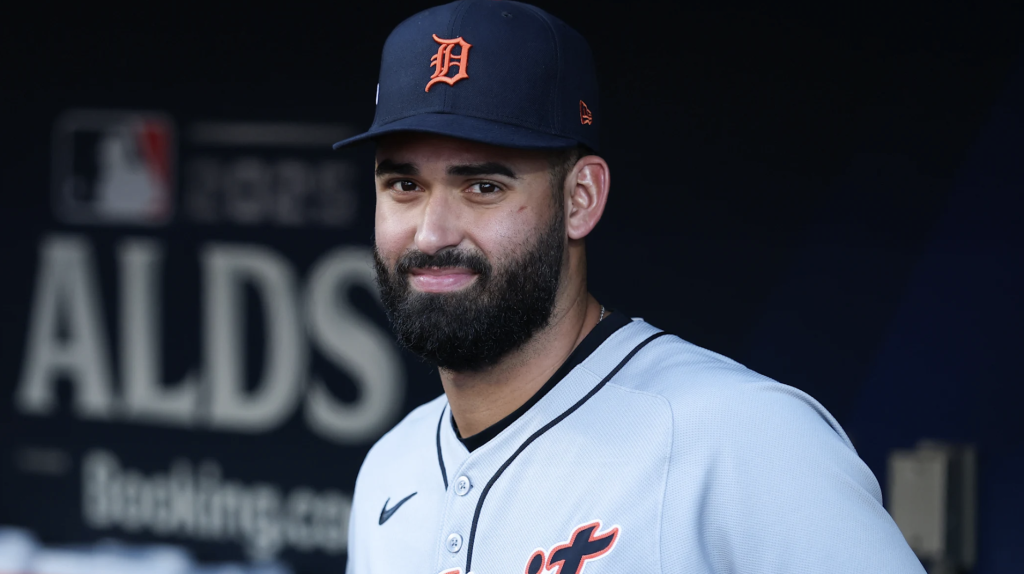

In 2025, Riley Greene became the first Detroit Tigers hitter to earn back-to-back All-Star selections since Miguel Cabrera. Now, he might be on track to become the franchise’s highest-paid player since Cabrera as well.

According to Bleacher Report’s Kerry Miller, Greene falls into the category of “the truly elite talents who teams are hoping will be the highly productive face of the franchise for a decade or longer” and could therefore earn upwards of $250 million on their next contracts. Greene will have just turned 28 when he reaches free agency in 2028 – still very much in his prime.

“Greene has slowly but surely blossomed into a real star, going for 36 home runs and 111 RBI during an age-24 campaign in which he was healthy enough to play in darn near every game,” Miller wrote. “The AL-high 201 strikeouts stand out as a concern, but Kyle Schwarber, Shohei Ohtani and Cal Raleigh all landed in the 187-197 range without anyone much caring. If he stays healthy and continues to mash, he could become a quarter-billionaire in a few years’ time.”

On the surface a compliment to Greene’s breakout, Miller’s analysis actually spells trouble for the Tigers in several interconnected ways. It’s flattering, yes, but from a team-building and financial standpoint, it’s the kind of projection that keeps small- and mid-market front offices awake at night.

Riley Greene contract prediction shows he is likely pricing himself out of Tigers’ budget

When an outlet casually mentions a player could become a “quarter-billionaire,” it’s a clear signal Greene is rapidly pricing himself out of Detroit’s comfort zone. The Tigers’ payroll has historically hovered in the middle of the pack – rarely extending beyond $150 million – and their largest contract ever remains Cabrera’s $248 million extension a decade ago. To even approach that figure again would require ownership to abandon its cautious spending model entirely.

If Greene stays on a superstar trajectory, his next deal will demand $30–35 million annually, something the Chris Ilitch-led Tigers have shown little appetite for outside of legacy players. One enormous deal could effectively handcuff the roster for years, forcing Detroit to cut corners elsewhere.

Miller also tried to downplay Greene’s strikeouts by lumping him with Schwarber, Ohtani and Raleigh, but those guys play in high-revenue markets that can live with flaws at a $200 million-plus price tag. Detroit isn’t that. The Tigers don’t have a margin for error on a nine-figure hitter who might lead the league in strikeouts. If Greene’s swing decisions regress or his power dips, a $250 million commitment becomes a crippling contract for a mid-market club.

The fact that Greene was “healthy enough to play in darn near every game” in 2025 is a subtle but important reminder that durability has not been a given. Long-term megadeals for players with prior injury concerns (especially those with lower-body issues like Greene’s) are among the most volatile in baseball. One re-injury could turn that $250 million “reward” into a sunk cost, and Detroit doesn’t have the resources to absorb that kind of blow.

If Greene becomes a $250 million player, the Tigers face a stark choice: pay him like a superstar and sacrifice flexibility to surround him with help, or let him walk and reset the rebuild clock again. Either outcome underscores Detroit’s recurring trap – develop one star at a time, then lose that star when he becomes too expensive. Without a sustained farm-to-payroll pipeline, these “success stories” can paradoxically stall progress.

Once national outlets start labeling Greene a “future $250 million man,” fan expectations skyrocket. If the Tigers don’t lock him up, they’ll be accused of cheapness. If they do, and Greene’s performance doesn’t match his salary, they’ll be accused of recklessness. It’s a lose-lose perception battle unless the front office threads the needle perfectly – something the modern Tigers haven’t shown consistent ability to do.

A $250 million Greene would be an incredible player. But for the Tigers, it would also be a roster-balancing nightmare, a financial gamble they’ve historically avoided and a public referendum on ownership’s ambition. If Greene truly becomes that valuable, the question won’t be whether he deserves the money, but rather, whether the Tigers can afford to keep him at all.

Leave a Reply