What if I told you that Kentucky’s world-famous bourbon industry is being pushed toward bankruptcy… not by bad business, not by changing tastes, but by a single political insult that Canadians refused to swallow?

That’s exactly what’s happening.

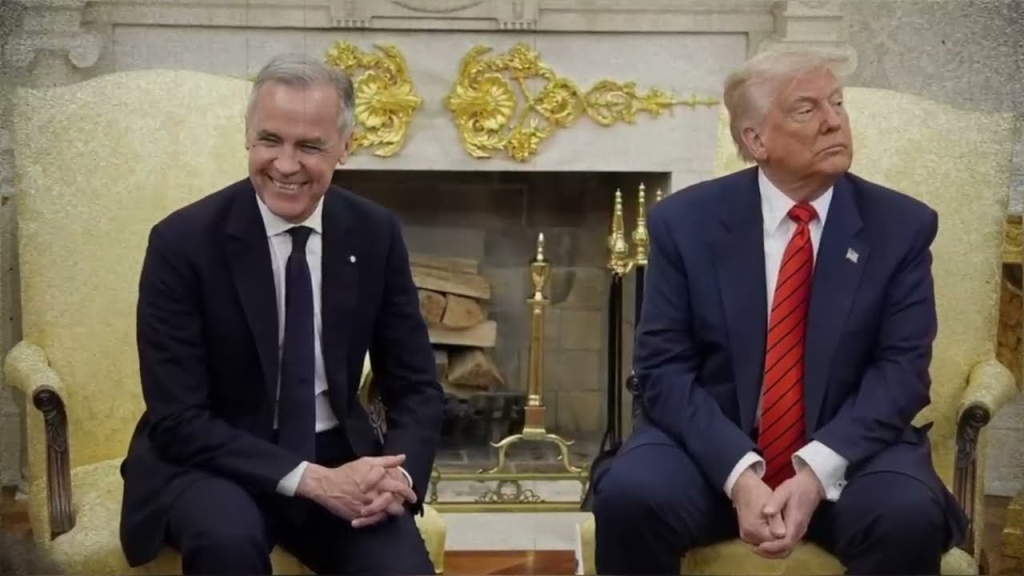

When Donald Trump casually suggested that Canada should just become the “51st state” of the United States, it sounded like typical tough-talk from Washington. But this time, Canadians didn’t shrug it off. They answered with their wallets. Within months, store shelves across Canada that used to overflow with Kentucky bourbon, Tennessee whiskey, and California wine were stripped bare of U.S. bottles.

Not by law.

By choice.

It became the largest alcohol boycott in North American history.

Behind the scenes, U.S. distilleries went into panic mode. Orders collapsed. Shipments stalled. Warehouses filled with unsold stock. By the time most Americans realized anything was wrong, major producers in Kentucky were already cutting shifts, freezing investments, and quietly talking to their bankers about one word nobody ever expected to hear around bourbon country: bankruptcy.

Nearly $1 billion in annual alcohol exports to Canada evaporated. But that was just the opening shock. Economists quickly realized the boycott wasn’t the disease—it was a symptom.

For decades, Washington treated Canada like a “safe market,” a quiet, dependable extension of the U.S. economy. Politicians assumed that no matter what tariffs, digs, or threats were thrown around, Canadians would keep buying American goods. That illusion just broke.

Canada isn’t a side market—it’s the number one export destination for more than 30 U.S. states. When Canadian demand drops, it doesn’t just hit distilleries. It rips through agriculture, logistics, transportation, and manufacturing.

Trucks that once hauled spirits north now sit idle. Rail lines lose profitable freight. Warehouses are stuffed with glass bottles, crates, and packaging that suddenly have nowhere to go. Overtime disappears. Shifts shrink. Layoffs creep in.

In the Midwest, corn farmers—who help feed the bourbon and whiskey industry—feel the squeeze as distilleries slash production. When barrels don’t move, crops don’t either. Rural towns, where farming and distilling are two sides of the same economic coin, watch their tax base erode. The ripple effects hit schools, roads, and basic services.

Meanwhile, ordinary Americans are about to feel their own version of this blowback.

Most households have no idea how deeply Canadian trade is baked into their daily lives. Auto parts, machinery components, food products, grid equipment—Canada is woven into all of it. When tariffs and political games clog that system, prices don’t just rise “on paper.” They jump on store shelves, repair bills, and utility statements.

Analysts warn that if this standoff continues, prices on many essential goods in the U.S. could climb 10–15% within 12–18 months. For families already crushed by inflation, credit card debt, and housing costs, that’s not a statistic—that’s the difference between staying afloat and going under.

And while America’s leaders posture, Canada is adapting. Fast.

Canadian breweries, wineries, and distilleries are booming as consumers proudly “buy local” instead of buying American. Every month the boycott continues, U.S. brands don’t just lose sales—they lose mindshare and emotional connection. Once Canadian drinkers get used to domestic and alternative suppliers, many may never go back to U.S. bottles at all.

That’s the nightmare scenario for Washington: if Canada can successfully replace American alcohol, what’s to stop it from shifting away from U.S. cars, meat, packaged foods, or industrial goods next?

Canada already buys more American exports than China, Japan, and the UK combined. Even a 10% permanent drop in demand would wipe out tens of billions in U.S. revenue and crush communities that are already on the edge.

Global competitors see the opening. European, Australian, and Asia-Pacific producers are racing into the Canadian market, eager to fill the space U.S. companies once dominated. At the same time, multinational corporations are quietly asking a dangerous question:

If U.S. trade policy is this unstable with its closest ally, is America still the safest place to build future supply chains?

Canada, backed by new and deeper trade ties with Europe and the Asia-Pacific, is positioning itself as a more predictable hub than the United States. That’s not a symbolic shift. That’s a potential long-term relocation of capital, factories, and jobs.

The real danger isn’t the loss of bourbon on Canadian shelves. It’s the loss of something far more valuable: the automatic trust that America will act like a steady, responsible economic leader.

Canada just proved it can weaponize its consumer power—and win.

The question now is chillingly simple:

If Washington keeps underestimating Canada, which American industry gets hit next?

Leave a Reply