Japan’s automotive giants — Toyota, Honda, Nissan, Mazda, Subaru — once stood at the pinnacle of global manufacturing. For six decades, they shaped the world’s highways, set engineering standards, and defined reliability. But today, the industry that carried Japan’s post-war rise is facing a threat more severe than any recession, oil shock, or production crisis it has ever encountered.

And the country threatening it is one Japan never expected to outrun it: China.

The collapse began with a familiar political earthquake. President-elect Donald Trump announced aggressive tariffs targeting Japanese cars, shattering a decades-old economic balance between Tokyo and Washington. The U.S., Japan’s most profitable export destination, suddenly became a minefield. Supply chains buckled. Production lines slowed. Factories slashed model lineups and budgets. And according to Nikkei Asia, the long-stable ecosystem that fed Japan’s automotive supremacy fell into chaos overnight.

But the tariffs were only the beginning.

Japan’s domestic auto market — once a dependable foundation — is shrinking at a historic rate. The population is aging fast. Younger citizens don’t want the financial burden of a car. In megacities where public transit is efficient and parking is a luxury few can afford, vehicle ownership is no longer a necessity. The Ministry of Economy reports that sales have fallen to levels not seen since the late 1980s.

Japan isn’t just facing a slowdown.

It’s facing a demographic cliff.

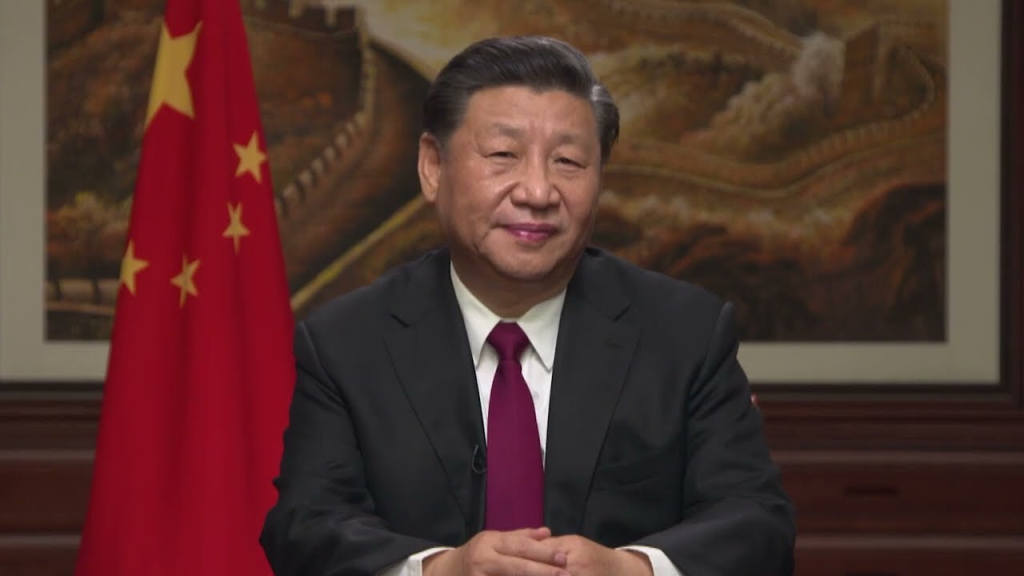

And into that vulnerability steps Beijing — not with tanks or takeovers, but with a strategy so comprehensive and slow-moving that most outsiders barely noticed it forming.

China spent years building something Japan never fully committed to: the complete electric vehicle ecosystem.

Raw materials? Controlled.

Lithium-ion batteries? Dominated.

EV platforms? Standardized.

Logistics? Integrated.

Recycling systems? Scaled.

China now controls most of the world’s EV supply chain — a reality that leaves nations without domestic battery centers increasingly dependent on Beijing. Japan, still invested heavily in hybrids and hydrogen, is suddenly behind the curve.

Bloomberg reports that China sees this moment — Japan’s shrinking demand, tariff-punished exports, weak battery infrastructure — as a once-in-a-century opening. Not to seize Japanese factories, but something far subtler:

To take control of the system that Japanese factories depend on.

Chinese state-backed firms are pouring into Southeast Asia — Thailand, Indonesia, Malaysia — regions where Japanese automakers built their offshore empires. Beijing offers joint ventures, “technology partnerships,” and shared EV platforms. The deals look harmless.

They aren’t.

Japanese analysts warn this is a three-step takeover:

- Create dependence on Chinese batteries.

- Embed Chinese technology into Japanese production pipelines.

- Expand control over Southeast Asian assembly hubs, logistics networks, ports, and suppliers.

End result:

Japan keeps its brand names.

China gains the real power — the infrastructure, the batteries, the components, the tech.

NHK and the Japan Times confirm Tokyo’s alarm. Internal documents show a growing fear that China could dominate Japanese automotive output without ever touching Japanese soil. It wouldn’t need to. Control the parts, control the factories.

Control the logistics, control the industry.

Meanwhile, China’s EV manufacturers — BYD, SAIC, XPeng — are sprinting ahead. They release new models every 8–12 months. Japanese companies take 3–5 years. In a market that moves at lightning speed, that’s the difference between leadership and obsolescence.

Chinese media openly declare a new era. Xinhua and Global Times say the age of Japanese automotive supremacy is ending — replaced by China’s vertically integrated EV empire.

And the truth is hard to argue with.

Beijing now controls rare earth supplies, battery megafactories, semiconductor hubs, shipping lanes, and power electronics clusters. They’ve built influence not through hostile takeovers, but through industrial gravity — pulling Japanese firms into an orbit where leaving becomes impossible.

Tokyo now faces questions once unthinkable:

What happens when Japanese companies can only build cars using Chinese batteries, Chinese chips, Chinese logistics networks, and Chinese supply chains?

What happens when Japanese factories abroad rely on Beijing’s approval to operate?

What happens when innovation timelines diverge so sharply that Japan cannot catch up?

Analysts warn that this is no longer a matter of competition.

It’s a matter of industrial sovereignty.

If Japan cannot accelerate innovation, expand domestic battery capacity, and rebuild its economic footing, the risk is stark:

A nation that pioneered global automotive excellence may soon find its industry operating under decisions made in Beijing.

This isn’t a takeover visible on a map.

It’s one happening in the shadows — factory by factory, battery by battery, port by port.

And unless Japan breaks free from China’s system, its automotive destiny could quietly slip out of its hands.

Leave a Reply